Seller confidence is returning to the real estate market, with new listings up 6.5 per cent in May.

According to PropTrack’s latest Listings Report, new listings on realestate.com.au have also climbed almost 20 per cent over the past 12 months.

“May continued the strong increase in new listings seen over 2024, with new listings in the month 18.5 per cent higher year-on-year,” PropTrack Senior Economist, Paul Ryan, said.

Mr Ryan said the past seasonal impacts from an earlier than usual Easter had corrected and new listings in May displayed the strength seen earlier in the year.

“New listings over 2024 to date are now 12.6 per cent above the same period in 2023, indicating continued vendor confidence.”

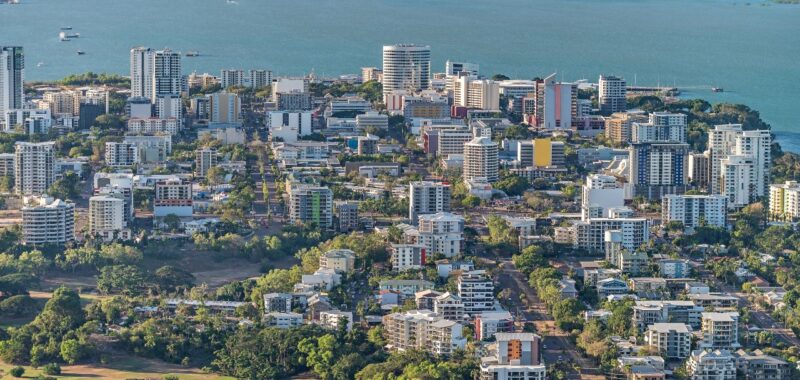

Across the capital cities, new listings were higher month-on-month in Darwin, which recorded a 41.2 per cent jump.

This was followed by the ACT (up 15.3 per cent) and Sydney (up 11.2 per cent).

The number of new listings was also 7.5 per cent higher over the month in the combined regional markets.

New listing volumes declined month-on-month in Perth (down 0.3 per cent) and Adelaide (down 3.8 per cent).

The report also showed that, year-on-year, new listings in the ACT have climbed 42.5 per cent, followed by Melbourne at 36.1 per cent.

“Although sales volumes have remained strong in 2024, the surge in new listings has seen an uptick in the total number of properties advertised for sale across the country, with the increase in total listings most evident in Sydney, Melbourne and the ACT,” Mr Ryan said.

“But other indicators – notably continued price growth – suggest buyer demand remains strong.”

On an annual basis, the only capital city to record a fall in new listing numbers is Hobart at 7 per cent.

For the combined regional areas, new listings have risen 10.4 per cent year-on-year.

“New listing activity has been strong following Easter this year, but as we now move into the typically quieter winter period of the year, the outlook will depend on continued strong buyer and seller sentiment, as well as expectations for interest rates,” Mr Ryan said.